Handmade business expenses MUST BE BOTH ordinary AND necessary, according to the IRS in Publication 535 – Business Expenses and Publication 334 – Tax Guide for Small Business, in order to be deductible on your Schedule C Tax Return. But what the heck does ordinary and necessary even mean? I’ll explain in this post.

What does IRS mean when they say handmade business expenses must be both ordinary and necessary? Let’s start with the definitions, according to the IRS

First off, just so you know, this applies to all types of businesses – not just handmade businesses.

- An ordinary expense is one that is common and accepted in whatever your industry is.

- A necessary expense is one that is helpful and appropriate for your specific trade or business.

Clear as mud, right? Yeah, not so much.

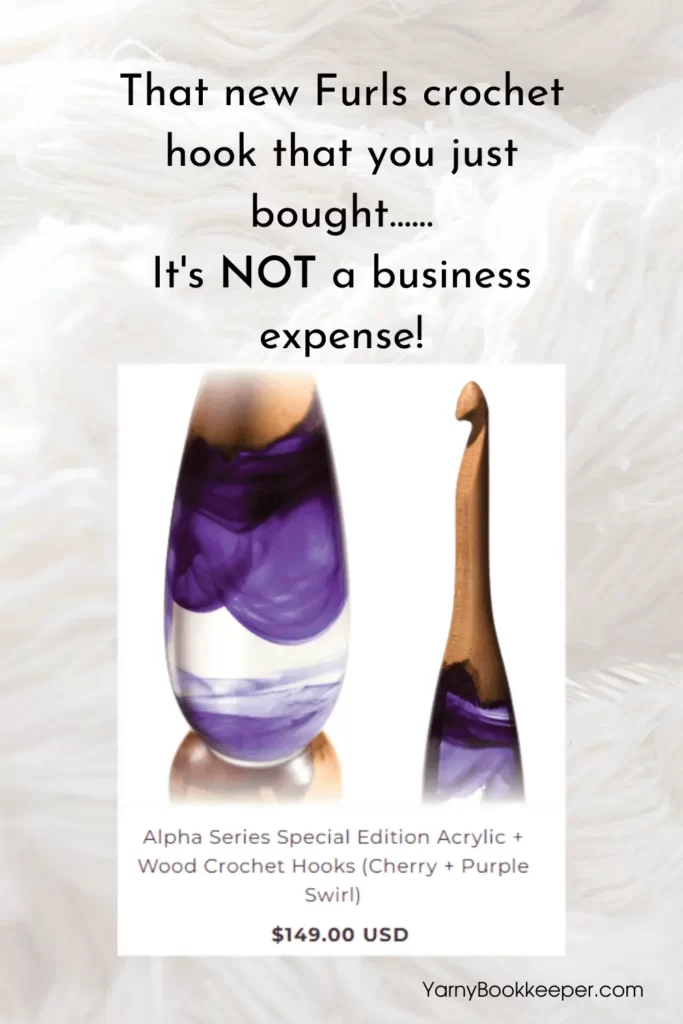

I have to be honest, I sort of got some flack for this Instagram reel I did a couple of weeks ago when I said “that new Furls crochet hook you just bought….is NOT a business expense”.

Ok, so it’s downright impossible to explain all this in 60 seconds or less in an Instagram reel or even in writing because you can only enter so many characters! It’s already taken more than a minute to type this up, and I’m a fast typer!

So, let me explain…….

First off….a crochet hook is both an ordinary and a necessary handmade business expense, but

If you crochet, then crochet hooks are both an ordinary and a necessary handmade business expense – otherwise how would you make your finished crochet items or design a pattern.

But, crochet hooks vary in price – from a single Simplicity Boye Ergonomic hook that you can buy at Walmart for $4.37 to a Furls Alpha Series Special Edition Acrylic + Wood (Cherry + Purple Swirl) for $149.00.

Handmade business expenses such as these should also be reasonable in addition to being ordinary and necessary. In this case reasonable applies to the PRICE you pay.

Some will argue state that Furls hooks are ergonomic and easier on their hands. That may very well be true, but is it REASONABLE to pay $149.00 for a single crochet hook? My answer would be a firm NO!

To be totally blunt, if you want that $149 crochet hook – it’s a personal expense, not a business expense.

I talk about this in “Myth #8 – Starting a handmade business will let you write of ALL of your expenses” in my free webinar Avoid These 10 Handmade Business Myths

The same holds true if you are a crochet hook “collector” and buy the same sized hook in the newest pretty color at $20 each. You don’t need the hook because you have a dozen others in the same size. Therefore, it’s neither reasonable, ordinary or necessary and is a personal expense..

Let’s talk about some other business expenses that may or may not be considered ordinary and necessary

- Quality/expensive yarns. If you make something or design a pattern and use it as an example of how the pattern would come out with a higher quality yarn (better drape, stitch definition) then it’s reasonable, ordinary & necessary. If you buy that skein of yarn for yourself because you want it then it’s not reasonable, ordinary, or necessary and would be a personal expense.

- Desk or table. A desk or a table would be considered an ordinary and necessary expense. However, what you pay for it determines if it’s reasonable. Spending $600 on an L-shaped desk that would provide both computer and assembly space would be considered reasonable, ordinary, and necessary. But spending over $1,000 on an L-shaped desk that matched to décor in your home would not. You could talk to your CPA about perhaps splitting the cost between business and personal.

- Ergonomic or supportive desk chair. If you spend a lot of time at your desk, then an ergonomic or supportive desk chair would meet that ordinary and necessary criteria.

- Computer. For many of us computers are a necessity. We use them to write our patterns, keep our books, design social media graphics, manage our social media, etc. And we use them a LOT – like several hours each day. In this case it makes sense to invest in a good (aka expensive up to $1,000) computer and it would meet all the criteria of reasonable, ordinary, and necessary. But if you buy a $2,000 gamer computer so your kids can play video games on it when you aren’t using it – that’s a personal expense. Or at least half of it – talk to your CPA.

- Smartphones. Many of us use our personal phones for lots of business related stuff. But it’s still our personal smart phone. Talk to your CPA.

In a nutshell

In reality, it’s really pretty simple to figure out the difference when you’re buying something. You just need to ask yourself “Am I buying (this) because I need it or because I want it”?

Using the definitions and the short list of examples provided will help figure out when something is or isn’t an ordinary and necessary handmade business expense.

Have questions about this post? Leave them in the comments below and I’ll be happy to answer them.

[…] Business expenses must be both ordinary and necessary […]