Step 1: Get Your Bearings

New here? Start with these beginner-friendly resources so you know know exactly where you stand and what your bookkeeping needs really are.

Helping handmade, creative and craft business owners learn to handle their bookkeeping, one step at a time!

Helping handmade, creative and craft business owners learn to handle their bookkeeping, one step at a time!

No matter where you’re starting from, these simple steps will help you get clear about your money, understand what you truly need, and choose a bookkeeping system that actually supports your handmade business.

Start with the step that matches where you are today — and grow from there, one doable win at a time.

New here? Start with these beginner-friendly resources so you know know exactly where you stand and what your bookkeeping needs really are.

There’s a LOT of misleading info online about starting a handmade business. This quick workshop clears the confusion so you can avoid costly mistakes.

This survey will help you figure out if your bookkeeping needs are simple or complex and what you should use for a bookkeeping system.

Learn the basics of how money moves in your handmade business — so you can make clear, confident decisions without second-guessing yourself.

HINT: It's earlier than you think..

If you’re making and selling handmade items, you need a bookkeeping system sooner than you think. This quick read breaks down the perfect time to start — and why waiting only makes things harder.

Why good bookkeeping records matter (especially at tax time): because guessing at your numbers creates stress, confusion, and panic. Good records give handmade business owners clarity, confidence, and a calmer path through tax season.

Now that you understand the basics, explore the tools and training that can help you stay organized, confident, and in control of your handmade business finances.

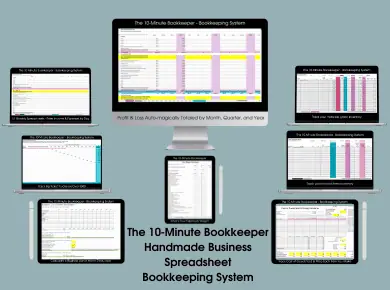

A maker-friendly spreadsheet system that helps you track income, expenses, COGS, and inventory in just minutes a day. Perfect if you want an easy, affordable bookkeeping solution without learning complicated software.

A more advanced course that teaches you the foundations of bookkeeping for handmade businesses — without the overwhelm. Learn how to track your money, stay organized, and finally feel confident about your numbers.

You love creating beautiful things — yarn, fiber, handmade goodness.

What you don’t love? The bookkeeping, the taxes, and the “wait… is this deductible?” moments.

This blog is your maker-friendly hub for bookkeeping, pricing, taxes, and all things handmade business money — explained in plain English, with a sprinkling of humor to keep things from feeling too… accountant-y.

Here, you’ll learn simple ways to understand your numbers, make confident decisions, and spend more time doing what you love (and a whole lot less time stressing over finances).

Confused about when inventory and Cost of Goods Sold actually affect your taxes? This post breaks down when inventory becomes COGS, why your profit can feel “off,” and how it all shows up on your Schedule C—without accounting jargon or panic.

This post was originally written & published 1/27/2020 and has been updated.

COGS doesn’t have to feel like a mystery novel. Here’s how to calculate cost of goods sold for one handmade item using a crochet amigurumi witch—materials, selling fees, and the bookkeeping flow. PLUS there’s a video showing how this is done using the 10-Minute Bookkeeper system including the Handmade Product Pricing & COGS Calculator. Part 7 of the Inventory + COGS for Handmade Businesses series.

Tracking Cost of Goods Sold (COGS) and inventory can feel confusing because bookkeeping, pricing, and taxes all use them differently. This post breaks down the 3 real reasons handmade sellers need to track COGS + inventory — with a full start-to-finish example so your numbers (and profit) finally make sense.

Real stories from real handmade business owners.