Tax preparers, bookkeepers, accountants, business advisors, CPA, Enrolled Agents!

WHO are these people????

WHAT do all these terms mean?

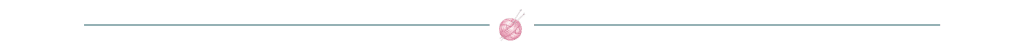

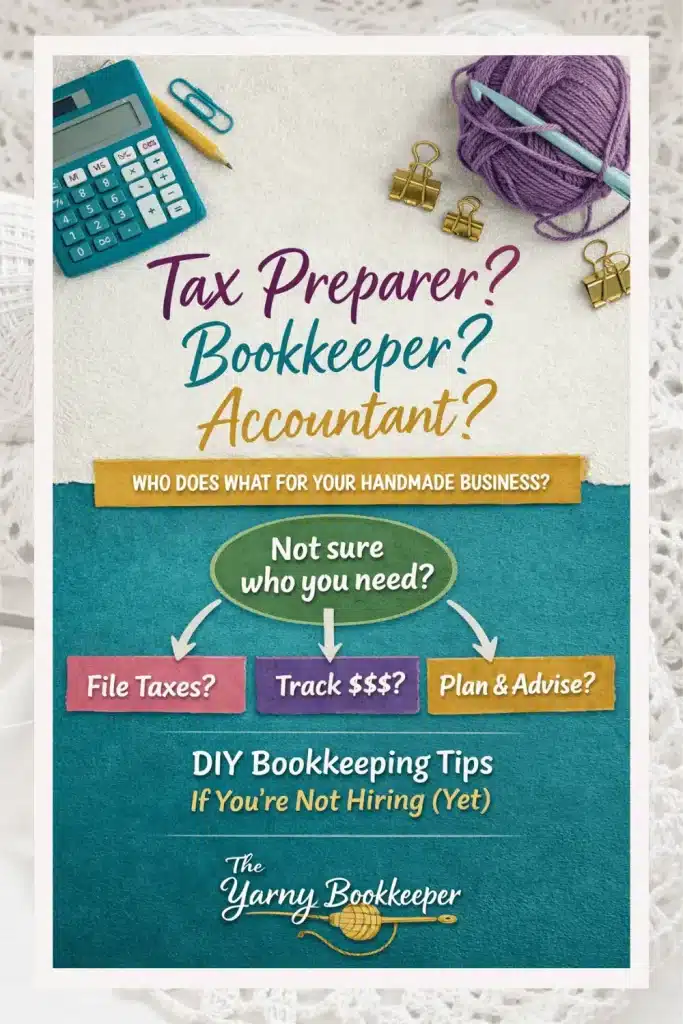

Confused about whether you need a tax preparer, bookkeeper, accountant, or business advisor for your handmade business? This post breaks down what each role actually does, when you need them, and how to choose the right kind of help — even if you’re DIY-ing your bookkeeping for now.

Most handmade business owners feel one of two things at tax time:

👉 panic

👉 or the strong urge to ignore everything until April

Somewhere in the middle of that stress spiral, you probably Googled things like tax preparer, CPA, bookkeeper, business advisor … and came away thinking:

“Okay … but who do I actually need?”

You’re not alone. The titles sound interchangeable, the advice online is conflicting, and nobody explains this in plain English — especially for handmade businesses with inventory, COGS, Etsy reports, craft fairs, and 47 different ways money comes in.

So let’s fix that.

This post explains:

- what role tax preparers, bookkeepers, and accountants actually play

- how business advisors fit into the picture

- when you might need them

and how to choose the right support without wasting money or sanity for handmade businesses.

Quick Answer (TL;DR)

If you just want the shortcut:

- Tax preparer: files the return

- Bookkeeper: keeps your books clean year-round (so tax time isn’t a dumpster fire)

- Accountant: interprets the numbers + helps with tax planning and higher-level decisions

- Business advisor: helps you make strategy decisions (pricing, growth, direction)

And yes — one person can sometimes do more than one of these.

Short on time, but want quick answers? Here’s what’s in this post:

- Who should you hire? (A decision chart to help you out)

- The shortcut version to who should you hire

- Can’t afford help yet? They DIY without regret plan

- The big picture + the titles and what they mean

- OMG – WHO do I need?

- Questions to ask before hiring anyone

- The bottom line

Escape the Google Spiral of Doom: Start Here

If you’ve been staring at job titles and feeling more confused than when you started, you’re not alone. Let’s save you from the Google spiral of doom — use this quick decision chart to figure out who you actually need right now (without overthinking it).

Who Should You Hire? (A Decision Chart to Help You Figure That Out)

Start here:

| Are you behind on bookkeeping or unsure your numbers are accurate? YES → ✅ Bookkeeper first NO → Keep going Do you just need to file your tax return correctly (and you already have clean numbers)? YES → ✅ Tax preparer NO → Keep going Do you want help lowering surprises and planning ahead (quarterlies, deductions, tax strategy)? YES → ✅ Accountant (tax planning) NO → Keep going Are you trying to make bigger business decisions (pricing, profit goals, scaling, product mix, “what should I do next?”) YES → ✅ Business advisor (and/or an accountant who offers advisory) NO → Keep going Do you sell physical products and feel fuzzy about inventory + COGS? YES → ✅ Bookkeeper who understands inventory/COGS (or help getting that system set up) |

The shortcut version (if you want to keep it super simple):

- Messy books / behind / unsure of COGS → Bookkeeper

- Books are clean, need filing → Tax preparer

- Want tax strategy + planning → Accountant

- Want decisions + direction → Business advisor

Can’t Afford Help Yet? Here’s the “Do-It-Yourself Without Regret” Plan

If that chart just showed you the ideal kind of help — and your brain immediately went,

“Yeah… except I can’t afford that right now,”

you’re not alone. Many handmade business owners start out doing their own bookkeeping, and that’s okay. Let’s talk about how to do this safely on your own (without creating bigger problems later).

But here’s the hard truth: a lot of makers are doing “bookkeeping” with patchwork systems — a spreadsheet here, a template there, and a quick copy/paste from Etsy (or other platforms) — without ever checking whether the numbers are accurate or what they’re actually telling you.

And that’s where things quietly go sideways and tax time gets risky fast.

The goal isn’t “fancy bookkeeping.” The goal is accurate bookkeeping

And just to be clear — DIY bookkeeping can be real bookkeeping when it’s done correctly. It’s not about whether you’re using software or spreadsheets. It’s about whether your records are complete, consistent, and reconciled to real bank and credit card activity.

Simply importing numbers, copying reports, or filling in a spreadsheet isn’t bookkeeping by default. Bookkeeping happens when you regularly check that the numbers are accurate, understand what they represent, and can explain where they came from if asked.

If you’re handling your own books for now, focus on accuracy over complexity or pretty:

- Use one system (even a simple spreadsheet) and stick with it

- Reconcile monthly (compare your records to your bank/credit card — this is where mistakes get caught)

- Track gross sales, fees, and refunds correctly — deposits ≠ income

- Separate personal and business spending as much as possible

- If you sell physical products, don’t ignore inventory + COGS (this is where makers accidentally blow up their profit)

👉 Feeling overwhelmed or confused? Check out the Bookkeeping Starter Series course:

A quick word about tax software……

Tax software is a tool — not a teacher. It can fill in forms, but it can’t always tell you if something is being classified correctly or if a rule has changed.

Tax laws change regularly, including rules that impact online sellers and handmade businesses. Clicking your way through software without understanding what it’s asking can lead to mistakes that don’t show up until much later.

If you’re DIY-ing, the safest approach is:

👉 learn the tax basics first — then use software to file, not to guess.

The best “I can’t afford help” compromise

If ongoing support isn’t realistic right now, aim for a small dose of clarity instead of doing everything alone:

- a one-time bookkeeping cleanup or setup

- help setting up inventory + COGS tracking

- a tax-time prep review before filing

A little guidance up front can prevent a lot of expensive fixing later.

The Big Picture, Before We Talk “Titles” … Tax Preparers, Bookkeepers, and Accountants: What’s the Difference?

Here’s the most important thing to understand:

👉 You may not need all of these roles — especially not at once.

👉 And the right support depends on what’s happening in your business right now.

A lot of handmade business owners jump straight to “I need an accountant” when what they really need first is:

a clean bookkeeping foundation — so the numbers are accurate before anyone tries to give advice or file anything.

Now let’s break down each role in maker-friendly language.

Tax Preparers: The “File the Forms” People

A tax preparer prepares and files your tax return using the information you provide.

That’s their main job: compliance.

“CPAs are licensed by their state board and must meet education requirements, pass the CPA exam, and complete ongoing continuing education.”

👉 Search for a CPA in your state.

One important thing to understand: tax preparers and tax software can only work with the information they’re given.

If your bookkeeping is messy, incomplete, or inaccurate, a return can still be filed — but that doesn’t automatically mean it’s correct or low-risk. Clean books matter, no matter who files the return.

This is also where a lot of confusion (and false confidence) creeps in. some tax professionals – specifically those who are Enrolled Agents (EA) have representation rights (meaning they can represent you before the IRS if something goes sideways), and some do not.

👉 Visit the IRS website to learn more about Enrolled Agents – what it means to be an EA and to download a list of active enrolled agents by state.

That’s something to ask before hiring.

You might need a tax preparer if:

- you want help filing correctly (and not wrestling tax software alone)

- your bookkeeping is already clean and organized

- you just want to hand it off and be done

Good to know:

A tax preparer usually does not:

- clean up messy books

- track inventory or calculate COGS

- help you understand your numbers month to month

Think of them as the person who submits the homework — not the one who helps you do it.

Bookkeepers: The Behind-the-Scenes Organizers

A bookkeeper keeps your business finances organized and up to date.

And here’s the part that surprises a lot of handmade business owners:

### Important: In the beginning, the bookkeeper might be… you.

For many handmade business owners, hiring help isn’t the first step — building a simple, accurate system is.

If you’re not outsourcing yet, think of bookkeeper as a role, not a person. And if you’re wearing that hat right now, your job is to:

- track the money accurately

- stay consistent

- and make sure your numbers match reality (not vibes)

That foundation is what makes tax time calmer — whether you file yourself or hand things off later.]

For a lot of handmade business owners, hiring help isn’t the first step — building a simple, correct system is. If you’re not ready to outsource yet, think of “bookkeeper” as a role in your business.

This is the role that prevents the classic handmade business tax season situation:

“I swear I made money, but I have no idea where it went… and my receipts are in three different places.”

Bookkeeping typically includes:

- categorizing income and expenses

- reconciling bank/credit card accounts

- keeping records consistent

- tracking inventory + cost of goods sold (COGS) where applicable

You might need a bookkeeper if (you can afford one and):

- your numbers live in spreadsheets, Etsy dashboards, or “I’ll deal with it later”

- you’re guessing at COGS or inventory

- you dread tax time because it becomes a giant clean-up project

- you want your books “tax-ready” before handing anything to a tax pro

Bookkeeping makes tax prep easier, cheaper, and way less stressful.

Accountants: The Financial Interpreters

An accountant is trained to analyze financial data and help interpret what it means.

Some accountants also do tax prep. Some focus on tax planning. Some do advisory work. (This is why it gets confusing.)

You might need an accountant if:

- your business is growing and you want better decisions backed by numbers

- you want tax planning (not just tax filing)

- you’re making bigger moves — hiring help, raising prices, expanding, etc.

A key thing most makers don’t realize:

👉 Accountants do their best work when your bookkeeping is already clean.

Messy books = limited advice (and usually higher fees).

Business Advisors: The Strategy Partners

A business advisor helps you make decisions about where your business is going.

This isn’t about categorizing transactions or filing forms — it’s about:

- pricing strategy

- offers and profit

- sustainability

- growth decisions that match your real life

You might need a business advisor if:

- you’re stuck and need a clear plan

- you’re unsure what to focus on next

- you want guidance beyond “here are your reports”

Some advisors have strong money skills… and some don’t. So it’s extra important to ask questions (I’ll give you some below).

Okay… So Who Do I Need?”

Here’s the honest answer for most handmade business owners:

Start with:

✅ Bookkeeping foundation + tax prep

Then add (as needed):

✅ Accounting / tax planning

✅ Advisory support

Because when your books are solid, everything gets easier:

- you know your profit

- you’re not guessing at COGS

- you’re not scrambling at tax time

- and you can actually use your numbers to make decisions

You don’t need a whole team. You need the right next step.

Questions to Ask Before Hiring Anyone

Use these to avoid paying someone who “technically” does the job… but leaves you confused and still stressed.

Ask:

- Do you work with handmade or product-based businesses?

- Are you comfortable with inventory and COGS?

- Will you help me get organized before tax time — or only file what I hand you?

- Do you offer ongoing support or only seasonal help?

- How do you want me to track my numbers during the year?

If someone can’t explain things clearly or makes you feel dumb for asking — that’s not your person.

One last thing — and this is about protecting yourself, not being picky:

don’t be afraid to verify credentials.

👉 The IRS maintains a directory of credentialed tax professionals, and it’s okay to confirm that someone is properly licensed and in good standing.

You’re not being difficult — you’re being responsible.

Now that you’ve seen how these roles fit together — and what to do if you’re handling things yourself — let’s pull this all together.

The Bottom Line

You don’t need to memorize job titles.

You need:

- clean numbers

- fewer surprises

- and support that fits how handmade businesses actually work

And if you’ve been working your way through this Tax Time for Handmade Business Owners series, you now understand the big moving pieces — what the IRS is looking for, how your money flows, and why bookkeeping (especially inventory + COGS) matters so much.

This post is here to help you decide — confidently — whether you want to keep DIY-ing with better systems… or bring in the right kind of help.

Because either way?

You deserve a tax season that doesn’t steal your sleep.

Now you’ve seen how these roles fit together — and what to do if you’re handling things yourself.