A physical year-end inventory is an absolute MUST for every creative or handmade business owner.

Let me start by saying that inventory is an animal all of it’s own. Inventory, just like any animal, needs constant attention.

EVERY creative or handmade biz that has inventory MUST:

- do a physical inventory when you decide to start your business (or finally make it legit)

- do a yearly physical inventory count and valuation – to see what they actually have on hand and for tax time (your accountant needs this to prepare your income tax returns)

- add items to inventory when you purchase something new

- subtract items from inventory when you use something

- remove items from inventory when you take something for personal use

- subtract items from inventory when you decide you aren’t EVER going to use something that you bought (think about that impulse buy of a skein or several skeins of yarn that you decided you absolutely detest working with and are going to either donate it or throw it out)

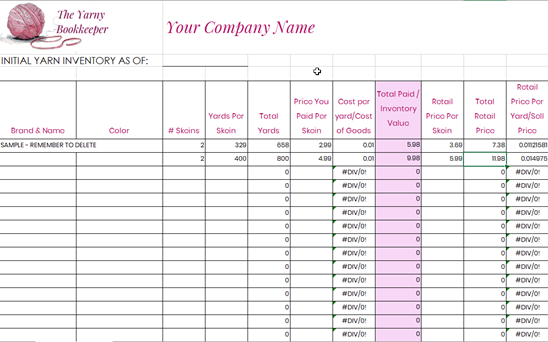

Now that you know the facts about inventory, join our Facebook group and download the FREE Initial Inventory Worksheet found in the Files section.

What exactly is inventory?

Inventory is essentially anything that you keep or have on hand that is part of your finished items – yarn, felt, material, beads, jewelry findings, wire, etc.

Inventory is also a business Asset and needs to be included in your your bookkeeping system and it’s value is part of your income tax return.

Inventory is NOT something that you purchase for a specific finished item.

Tips for doing a physical inventory

Step 1: Get your stash organized

The first thing that you want to do is get your stash organized – especially if you have NEVER done a physical inventory. So, grab yourself some storage boxes (or empty out some that you already have), label them:

- To inventory – things you’ll definitely use in your finished items

- These are MINE – things that you want for yourself

- Partial skeins (packages)

- Really small bits and pieces

- Stuff I’ll never use

Now, start going through your stash and put it into the boxes. Once the “To Inventory” box full, add it to your inventory list and then pack it away.

Step 2: Find & determine the price you paid AND the retail price

You may run into some road blocks when actually entering your inventory items – a common road block is that you simply don’t have the receipt or know what you paid for the item.

When this happens, simply go online and find the retail price (because you always want to charge the retail price when you sell the finished item even if you got the item on sale or at a wholesale price) and if you don’t have a receipt – the cost goes in as 0 (zero).

I know this isn’t very scientific or exact – but in this case – it’s close enough – and probably this is the ONLY time I’ll ever suggest any sort of shortcut when it comes to bookkeeping. Later down the road, you’ll get more exact because you’ll be entering your inventory purchases as you make them.

Step 3: These are MINE

Anything that you are going to use for yourself should not be entered into the initial inventory for your business and should be kept separate. If you later take something out of inventory for personal use, that’s ok – but you do need to account for it at that time by removing it from inventory.

Step 4: Inventorying partial skeins/packages

Another common roadblock is when you have partial skeins of yarn or partial packages – think a partial skein of yarn and you have no idea how many yards there is left.

Hopefully the wrapper is still intact (if not and you know the brand go online and find it). If you find that a full skein weighs 6 ounces and has 315 yards – get yourself a food scale and weigh it. Here’s the formula:

315 yards divided by 6 ounces = 52.5 yards per ounce multiplied by the number of ounces you have = the number of yards (roughly) that you have.

Again, this isn’t exactly as accurate as if you actual measured the yardage, but in this case – it’s close enough.

Step 5: Dealing with those really small bits & pieces

I know that I have a box of odds & ends of yarn – you know what I mean those 10-15 yard scraps. I usually hand wind them around the yarn wrapper and just throw them in a box (you never know when you’ll need just a few yards to make a flower or 2). Just throw them in the box, don’t worry about putting them into inventory – BUT when you do use them, MEASURE them, come up with a price per yard and add that amount to your costs of making the item.

Step 6: Stuff I’ll NEVER use

If you are anything like me, you’ve probably bought yarn and other supplies as an impulse buy when they were on sale, tried them and decided that you didn’t like it for whatever reason and will never use it. My advice – GET RID OF IT! Donate it, sell it, or simply throw it in this week’s trash – but don’t let it take up valuable space or put it into your inventory.

If this is your VERY first physical inventory – do NOT include the things that you’ll never use. If you have done an inventory previously remove them from inventory now.

Note:

Using a bookkeeping and accounting system, such as QuickBooks Premier desktop, will help you tremendously! QuickBooks Premier has a built in Inventory system. If you faithfully enter your purchases into inventory, at the end of the year – with a click of a button – it will provide you with a Physical Inventory Worksheet. This really takes the hassle out of doing inventory counts!

I know inventory is everyone’s LEAST favorite topic and task, but which do you think is going to be easier – using a spreadsheet to track your inventory or software?

[…] Year-end physical inventory tips […]