I bet you’re wondering, WHEN does Inventory & COGS (Cost of Goods Sold) hit my bookkeeping? More specifically when do project costs appear on your Profit & Loss Report under Cost of Goods Sold (if you want to go all accounting speak) and then what about my tax return?

If you’ve been following along this month, you’ll find that I’ve been focusing on Inventory & briefly touching on Cost of Goods Sold:

- Part 1 – What is Inventory?

- Part 2 – How to Track Inventory

- Part 3 – Why Track Cost of Goods Sold?

Today, in Part 4 – How do Inventory & COGS hit my bookkeeping, we’re going to finish this series.

In Part 1, I talked about how materials and supplies are probably the BIGGEST spending category many of us have in our handmade or creative business.

- BUT we can’t expense or deduct materials and supplies in the year that we bought them

- We MUST wait until the year that we sell the finished item BEFORE we can deduct the cost of the supplies used in that item as Cost of Goods Sold

- And, you need to keep detailed records of what you bought, how much your bought and what you paid for it in the meantime

What I didn’t mention (because I didn’t want to overwhelm you) is that ALL of those detailed records that you need to keep for yourself are actually going to help you complete the Cost of Goods Sold section on your Schedule C at tax time.

Inventory to COGS (Cost of Goods Sold) – The journey of a skein of yarn.

So, here’s a little story about the journey of a skein of yarn – from the time you buy it to the time you actually sell something made from it.

- Buy yarn in 2018 (Cost $28.52).

- Take yarn home – enter purchase transaction, record costs in Inventory and put it in stash.

- Yarn sits………..

- Year end – time for taxes. (2018 Ending Inventory Value – $28.52 and that amount is shown on your Balance Sheet – BUT no where else!)

- Now it’s 2019 – actually make something with yarn 🙂

- Still inventory but now we need to move costs ($0.88) OUT of Materials Inventory and INTO Finished Items Inventory. (Total Inventory Value still $28.52)

- Buy more yarn ($99.98) , make more stuff.

- 2019 over & done – tax time again 🙁

- Ending Inventory Value = $128.50 ($28.52 Beginning balance of Inventory PLUS $99.98 in purchases)

- No Sales this year (BOO)

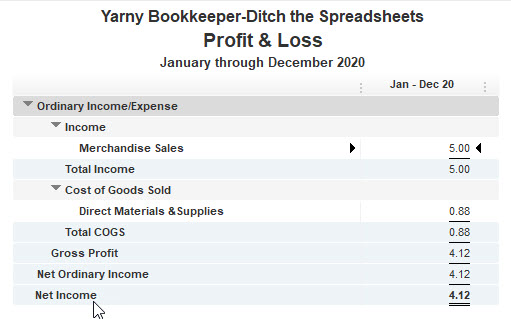

- Welcome to 2020! When we ACTUALLY sell that Item we made a year ago for $5.00.

- Sales price of finished item ($5.00) hits Income or Sales.

- Cost ($0.88) to make item FINALLY comes out of Inventory and hits COGS (Cost of Goods Sold)!

This is the “short version” of the journey of that skein of yarn in your bookkeeping records over a 3 year period!

Do you understand now why I keep harping about tracking all the details for your finished items?

Now, let’s talk about how all these inventory details end up on your tax return!

Here’s a screen shot of how Part III Cost of Goods Sold shows up on your Schedule C for 2018.

- You had no beginning inventory

- Purchases of $28.52

- No Sales – meaning you can’t deduct materials used

- Inventory at the end of the year – $28.52

- Cost of Goods Sold $0.00

Now, for a look at Part III Cost of Goods Sold on your Schedule C for 2019.

- Beginning Inventory $28.52

- Purchases $99.98

- No Sales – meaning you can’t deduct materials used

- Inventory at the end of the year $128.50

- Cost of Goods Sold $0.00

If you’re wondering how all this REALLY looks in your bookkeeping records and how it’s done when using spreadsheets vs. QuickBooks. then:

Watch the replay of my free 90-minute webinar “Thinking of ditching the spreadsheets and using (QuickBooks) software for your bookkeeping needs”.

Until next week, when we start talking Budgets!

![[My Handmade Biz] When does Inventory & COGS hit my bookkeeping? Sometimes it can be 2 or 3 years before you sell an item and get to recognize the COGS. This is why keeping detailed records is important.](https://yarnybookkeeper.com/wp-content/uploads/2020/01/2020-01-27-Inventory-to-COGS-810x500.jpg)