There are so many different ways of keeping track of your business receipts and keep the paperwork organized for your handmade business, here are a few tips that I find most helpful.

We purchase something in a store and we’re asked “Would you like a receipt?” from the person checking us out. Unfortunately, we hear this question so often that we almost tune it out with an automatic “No thanks.” But keeping track of your business receipts is very important when you own a small, handmade business.

As handmade business owners (or any type of business owner) you need to keep all your receipts:

- in order to know how much you paid for a specific skein of yarn or any other material you buy

- to provide backup documentation to your tax preparer

- and, in case your tax returns are audited by the IRS

You may hear some folks say that you don’t need to keep receipts for expenses under $75.00. I’m going to tell you to keep EVERY one of your receipts, because arguing with the IRS can cost you a lot more time and money in the event of an audit – PLUS – you need all that detail in order for you to know the cost of materials for a specific handmade item.

Relying on bank or credit card statements just isn’t enough. While both will show that you spent $100.00 at Hobby Lobby (for example), what they don’t show are the details about your purchase and you need this information for the reasons stated above.

Throwing all your receipts into a box also isn’t enough. Sure you have them all, but how long is it going to take you to find a specific receipt when it comes time to tally up the costs of a finished item or you need to produce it for your tax preparer or {gulp} the IRS auditor?

Now that we know WHY it’s important to keep track of our business receipts, let’s talk about HOW we keep all those important little pieces of paper organized.

Keeping and managing your receipts

The first really good habit that you want to get into is making/keeping notes on the actual receipt and keeping them all together and organized by year and month, either in:

- some sort of file box or accordion folder

- a folder on your computer (NOTE: If you’re storing receipts on your computer, make sure this folder is backed up)

- a folder in a free (or paid) cloud storage system like Google Drive, DropBox, OneDrive, etc. (Remember these systems can be synced with your computer and devices so they are always available.)

Tip #1 – Managing Paper receipts from brick & mortar stores

You want to do make notes on paper receipts as soon as you get home and begin unpacking your purchases, while all the details are fresh in your mind and the items you purchased are right there in front of you. I usually put my receipt directly into the bag.

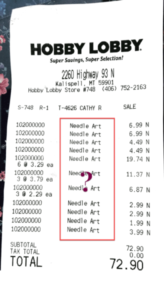

To the right is an image of an actual receipt I received after stopping at a Hobby Lobby while on vacation this summer.

Look at this receipt carefully, there are several things wrong with it:

- everything is coded “Needle Art”

- it provides me with no detail about what I purchased for my own internal bookkeeping procedures

- it provides no detail about my purchases as backup documentation for my tax preparer or in the event of an IRS audit.

I have an app on my phone called Scannable (available for Apple products only, sorry) it connects to Evernote (which I use all the time) or can work independently. Scannable allows me to scan the receipt with my phone, and then:

- mark it up

- save it as an image

- save it as a pdf

- email it to myself

- upload it to Google Drive

- or send it directly to Evernote.

Tip #2 – Managing email receipts

When we purchase something on-line, we receive an email receipt with all the lovely details of our purchase. Our natural reaction is to just leave it sitting in our Inbox or maybe we move it into a folder in our email account. Either way that email receipt gets hidden and finding it can be quite the challenge.

- Print the email receipt and file it your accordion folder

- print it to a pdf and save it to your cloud storage folder or the folder on your computer

- make sure the receipt includes the payment type

Tip #3 – Enter your receipts in your books

The last step in organizing your receipts, is to enter them in whatever you use to do your bookkeeping and categorizing them correctly, it’s the ONLY way that you’ll be able to keep track of your expenses. Whether you use spreadsheets or software, set aside time each week to do your bookkeeping – spending 30 minutes or so every week is SO MUCH better than having to spend hours later on down the road!

That’s it for this week.